A credit dispute letter, as its name depicts, it is about mentioning the problem regarding the credit payment between the client and the financial institute. A Credit letter is issued by the bank or any financial agencies. This letter ensures the honesty and integrity of both the purchasing party and the selling party. The person who sells goods promises to meet the terms and conditions covered in the letter. The bank also represents the purchaser and makes a promise to pay the full amount for the goods on time. Discovering or resolving mistakes on a credit letter is a complicated process. These mistakes are represented by writing a credit dispute letter.

A credit dispute letter is necessary when you face in issue regarding your credit account. Here a sample is provided for your basic knowledge.

Credit Dispute Letter Sample

From

Jessica J. Marshall

3748 Nixon Avenue

Johnson City, TN 37601

Aug 11, 2014

To

Herbert Gerard M. Kent

Director, Home Park Finance

1588 Tavern Place

Madison, WV 25130

Dear Sir/ Madam,

I have received a duplicate of credit report having number 4672 from your respected agency and I found that the subsequent item had a slip-up:

Item 1: A disagreement about the YKL credit card number 4672.

This account has been fully paid, whereas the statement says that there is an imminent quantity on that financial credit.

I request you to provide an immediate attention to this letter. And I hope that such kind of problem will not be repeated again in the future. I hereby enclose my present bank statement to confirm my testimonial.

Truly yours,

Jessica J. Marshall

Enclosures: Bank Documents

Given Below are a few credit letter samples for a clearer Idea.

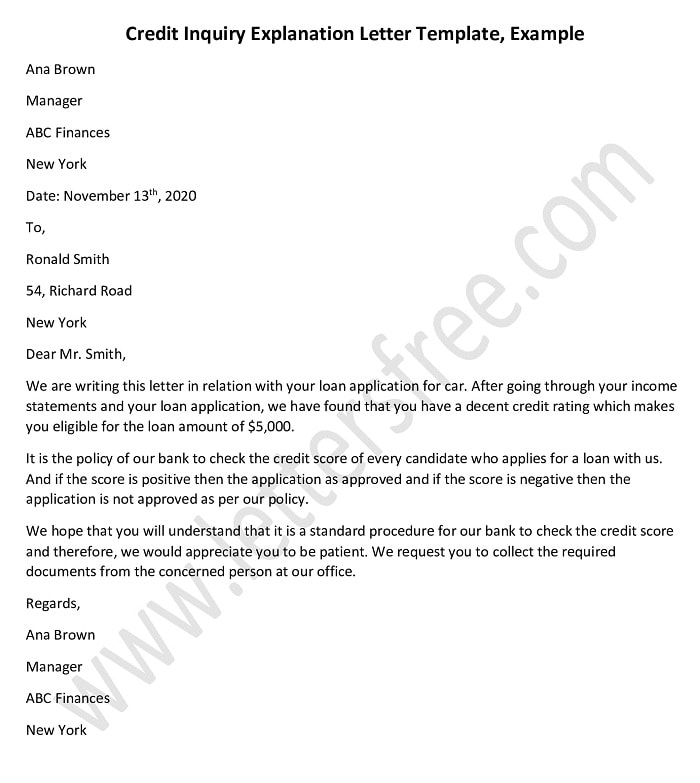

Credit Letter of Explanation

A credit letter of explanation is written to give the detail of any credit application to the bank as per the rules of the concerned financial institute.

Credit Deletion Letter

A credit letter of deletion is a request to remove inaccurate remarks from your credit report.

Credit Denial Letter

A credit denial letter is issued by the bank to an applicant. This letter is sent to a credit applicant informing him or her that the credit application has been denied.

Credit Approval Letter

A credit approval letter is issued by the bank to the client that approves the client’s ability to take the credit from any financial institution.

Credit Repair Letter

Credit repair letter could be a powerful tool in dealing with credit repair businesses.

Credit Inquiry Explanation Letter Template, Example

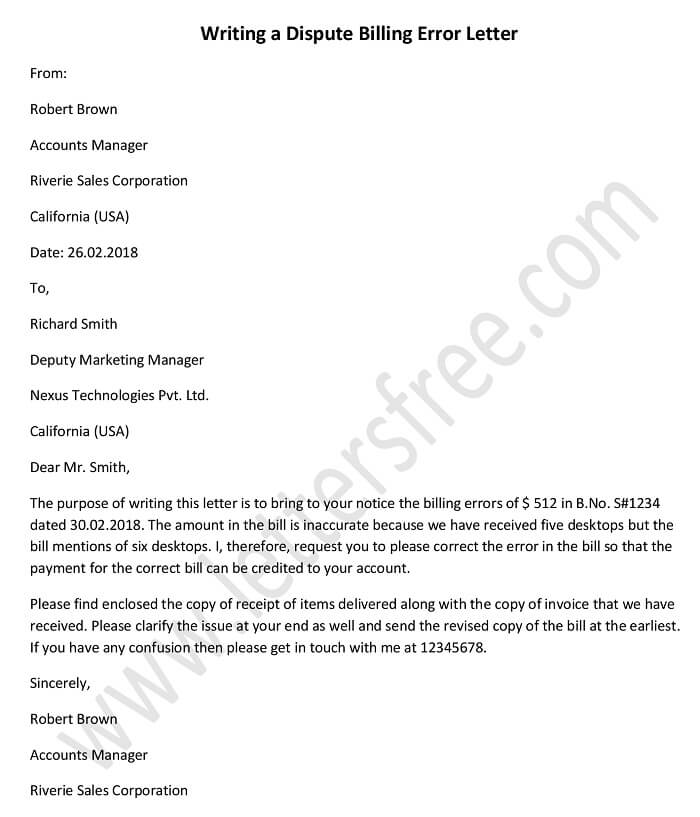

Credit Inquiry Explanation Letter Template, Example Writing a Dispute Billing Error Letter | Dispute Letter Template

Writing a Dispute Billing Error Letter | Dispute Letter Template