Credit repair letter could be a powerful tool in dealing with credit repair businesses. It serves as the most promising method in fixing the inaccurate grades given to a client or patron on its credit report. It helps you in presenting your side of the matter in an organized and effective manner. It covers all the relevant information regarding your credit report properly.

The main purpose of this written document is to clarify the incorrect points. It settles your credit issues with credit bureaus to facilitate an accurate and legitimate report. You can also settle your credit card issues as a client through this letter with the company where it is used.

Sample Credit Repair Letter

From

Mr. Leonardo Charles

89, Follies Road

Fisher Towers

New York 7889

To

Service Department

Head and Main Finance

West Hampshire

New York 4546

Date: 11 Jun, 2014

Subject: Credit Repair Letter

To whomsoever it may concern,

This is to notify you about the inaccurate credit report send by Service Department of Head and Main Finance. I have received this document on 18 February, 2014.

I would like to give details about some points regarding the inaccurate credit report. As per the clause mentioned in the “Fair Credit Reporting Act” of 1996, I deserve some modifications in my credit report. Kindly, provide me those required changes and rectification for the information that is not factual in my case but is incorporated in my credit report.

I would like to request you to send me a copy of the accurate credit report based on the aforementioned act, immediately. I would also like to clarify that Head and Main Finance is responsible for this inaccuracy. Hence, process these changes without any extra charges.

I have marked all the incorrect or the objectionable points of the credit report in its copy that I have enclosed with this letter. I have also attached some other relevant documents with it.

Your prompt and positive action is anticipated. Thank you in advance for your consideration.

Sincerely,

Leonardo Charles

Given Below are a few credit letter samples for a clearer Idea.

Credit Letter of Explanation

A credit letter of explanation is written to give the detail of any credit application to the bank as per the rules of the concerned financial institute.

Credit Deletion Letter

A credit letter of deletion is a request to remove inaccurate remarks from your credit report.

Credit Dispute Letter

A credit dispute letter, as its name depicts, it is about mentioning the problem regarding the credit payment between the client and the financial institute.

Credit Denial Letter

A credit denial letter is issued by the bank to an applicant. This letter is sent to a credit applicant informing him or her that the credit application has been denied.

Credit Approval Letter

A credit approval letter is issued by the bank to the client that approves the client’s ability to take the credit from any financial institution.

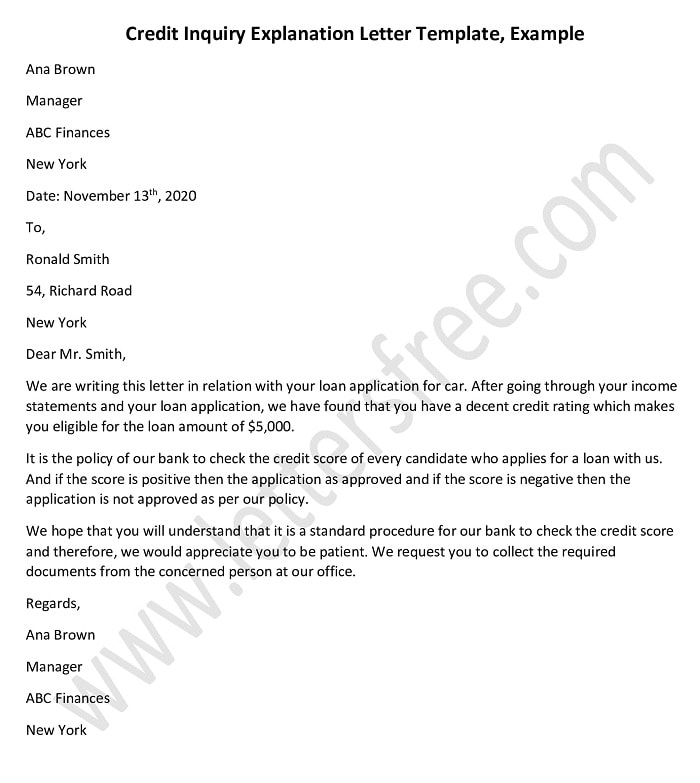

Credit Inquiry Explanation Letter Template, Example

Credit Inquiry Explanation Letter Template, Example